Analysts Predict Bitcoin Could Soar by Year-End

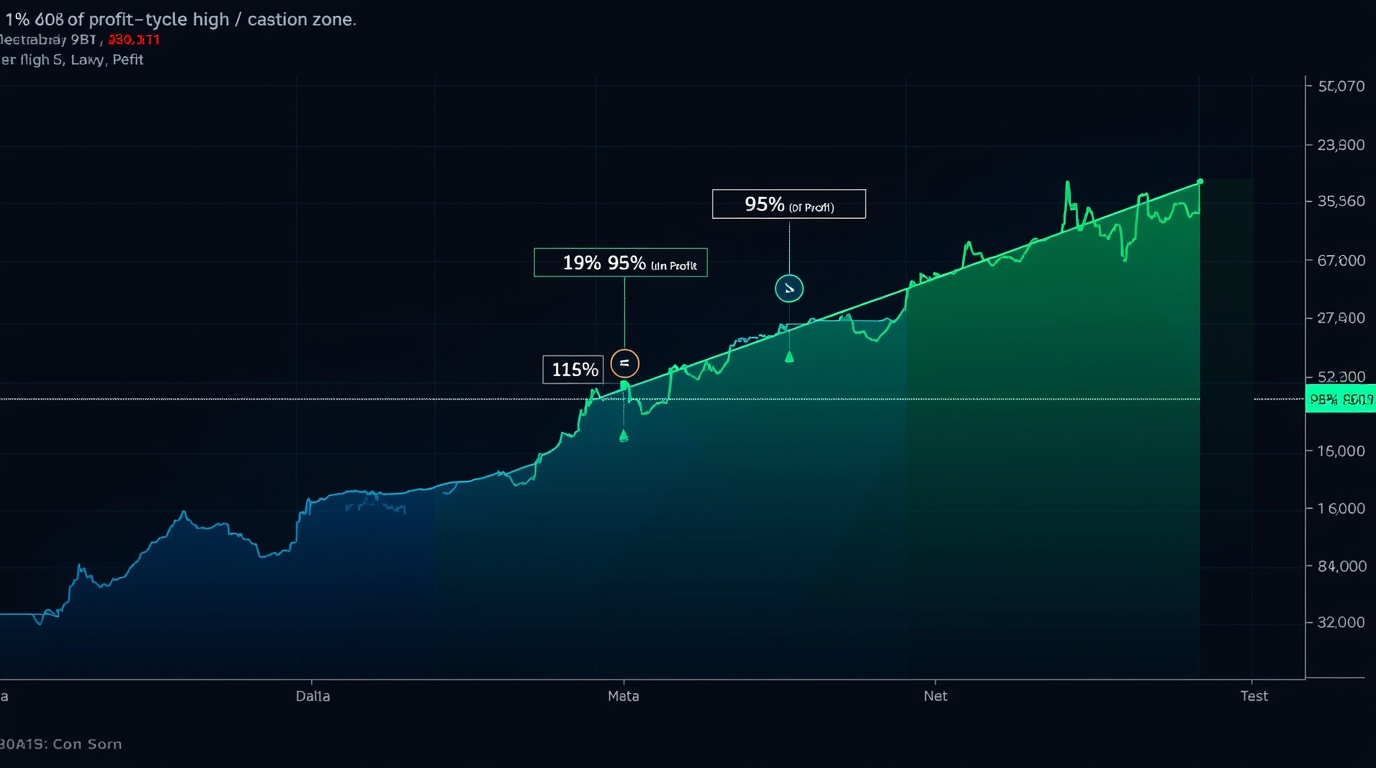

The latest Bitcoin Price Prediction 2025 from Tephra Digital has stirred excitement in the crypto market. According to their analysts, Bitcoin could surge to a range between $167,000 and $185,000 by the end of the year.

Why the Correlation Matters

The correlation between Bitcoin, M2 money supply, and gold is crucial to this Bitcoin Price Prediction 2025:

M2 as a Liquidity Indicator: When global money supply expands, risk assets often follow. Bitcoin’s lagged response indicates it could soon reflect recent liquidity increases.

Gold as a Benchmark: Bitcoin’s “digital gold” narrative remains strong, and its performance has mirrored gold in times of inflationary pressure and economic uncertainty.

Historical Reliability: Since late 2023, the 100-day lag correlation has remained consistent, reinforcing the credibility of Tephra Digital’s forecast.

Bitcoin’s Bullish Momentum Builds

The market has already witnessed Bitcoin breaking key resistance levels this year. With institutional adoption growing and ETFs fueling liquidity, the conditions appear favorable for another upward leg. If Bitcoin aligns with Tephra Digital’s Bitcoin Price Prediction 2025, investors could be looking at one of the most explosive year-end rallies in crypto history.

Risks to Consider

While the projection is exciting, investors must weigh risks. External shocks such as regulatory crackdowns, global liquidity tightening, or profit-taking events could cause volatility. However, the underlying macro drivers—money supply growth and Bitcoin’s store-of-value appeal—remain intact.

What This Means for Investors

For both retail and institutional players, the Tephra Digital Bitcoin Price Prediction 2025 offers a compelling case for long-term positioning. If history continues to rhyme, Bitcoin could deliver returns that outpace traditional assets and strengthen its claim as the cornerstone of digital finance.

Final Thoughts

The forecast of Bitcoin reaching $167K-$185K by year-end underscores the cryptocurrency’s growing importance in the global financial system. By following M2 and gold, Bitcoin is carving out its role as both a liquidity-driven asset and digital gold.

Don’t wait on the sidelines—explore Bitcoin now and ride the wave toward the future of money.